VALUATION AND ADVISORY

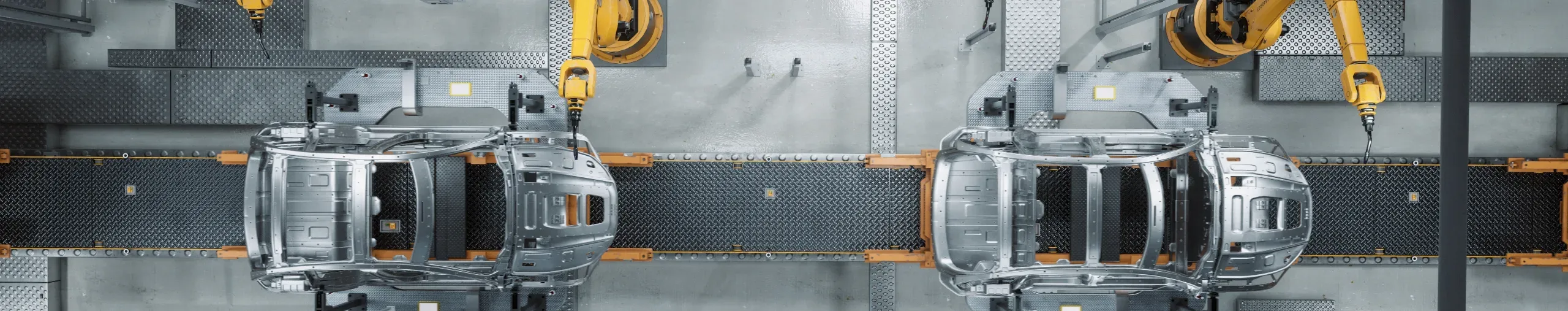

Plant and Machinery Valuation

Asset-level insights that power smarter decisions.

Our RICS-compliant valuations help operators, lenders, auditors, and investors understand the true worth of plant, machinery, and equipment — with sector-specific precision and international reach.

From manufacturing to healthcare, machinery assets are critical to operational performance and capital efficiency. We support clients across MENA with specialist, asset-level advice that informs financial reporting, acquisitions and disposals, secured lending, insurance, and litigation.

With over two decades of regional experience, we deliver best-practice reporting aligned with global standards and local regulations. Our Dubai-based team works closely with international specialists, ensuring cross-border consistency with insight tailored to asset type, condition, and usage.

Why trust us with your plant and machinery valuations

We value billions in assets annually for clients across MENA and beyond.

What we value

Our team delivers plant and machinery valuations across a wide industrial and infrastructure landscape – from large-scale energy assets to specialist facilities.

Sector coverage

- Oil and gas: Upstream and downstream operations, rigs, dredgers, terminals, tank farms, and petrochemical complexes

- Green energy: Solar, wind, hydrogen, and biothermal projects

- Public utilities: Power plants, waste treatment facilities, desalination plants, and related infrastructure

- Pharmaceuticals and healthcare: Laboratories, production sites, and distribution hubs

- Metals and mining: From extraction operations to processing facilities

- Manufacturing and engineering: Industrial plants, workshops, and automated systems

- Marine vessels: Working ships and port-based equipment

Asset types

- Manufacturing and industrial equipment

- Energy, utilities and power generation assets

- Transport and logistics infrastructure

- Printing presses and packaging lines

- Medical and diagnostic equipment

- Agricultural and construction machinery

- Engineering and precision tooling

- Fixtures, fittings, and specialist plant

- Entire operational facilities or individual assets

How we work

Our valuations follow global best practices and local compliance standards — including RICS 'red book' — and are suitable for a wide of scenarios.

- Financial reporting

- Tax and financial reporting

- IFRS/IAS accounting compliance

- Asset acquisition and disposal

- Secured lending and refinancing

- Insurance and reinstatement assessments

- Asset retirement obligations (ARO)

- IPO and fundraising for loan security

- Mergers and acquisitions

- Liquidation and insolvency

- Internal management or shareholder reporting

Request your commercial asset valuation today.

Destination Dubai 2025: Dubai Real Estate Market Outlook for Global Investors

In our flagship annual publication, Destination Dubai 2025, we surveyed 387 global HNWI respondents across the UK, India, Saudi Arabia and East Asia (China, Hong Kong, Singapore) to understand their attitudes, appetites, and aspirations towards investing in property in Dubai.

21 May 2025

Read the report