Real estate assets affecting your financial statements

In the current dynamic business environment, there has been an increased need for recording transactions and assets in the financial statements in the most transparent and informative manner for all stakeholders, usually under the International Financial Reporting Standards.

Tangible assets, more specifically real estate is no different and Knight Frank’s Valuation team has been increasingly involved with its clients in the Kingdom assisting them with Transaction Related Valuation under the guide of IFRS 3 - Business Combinations and IFRS-13 Fair Value Measurement and impairment testing exercises (IAS 36 – Impairment of Assets).

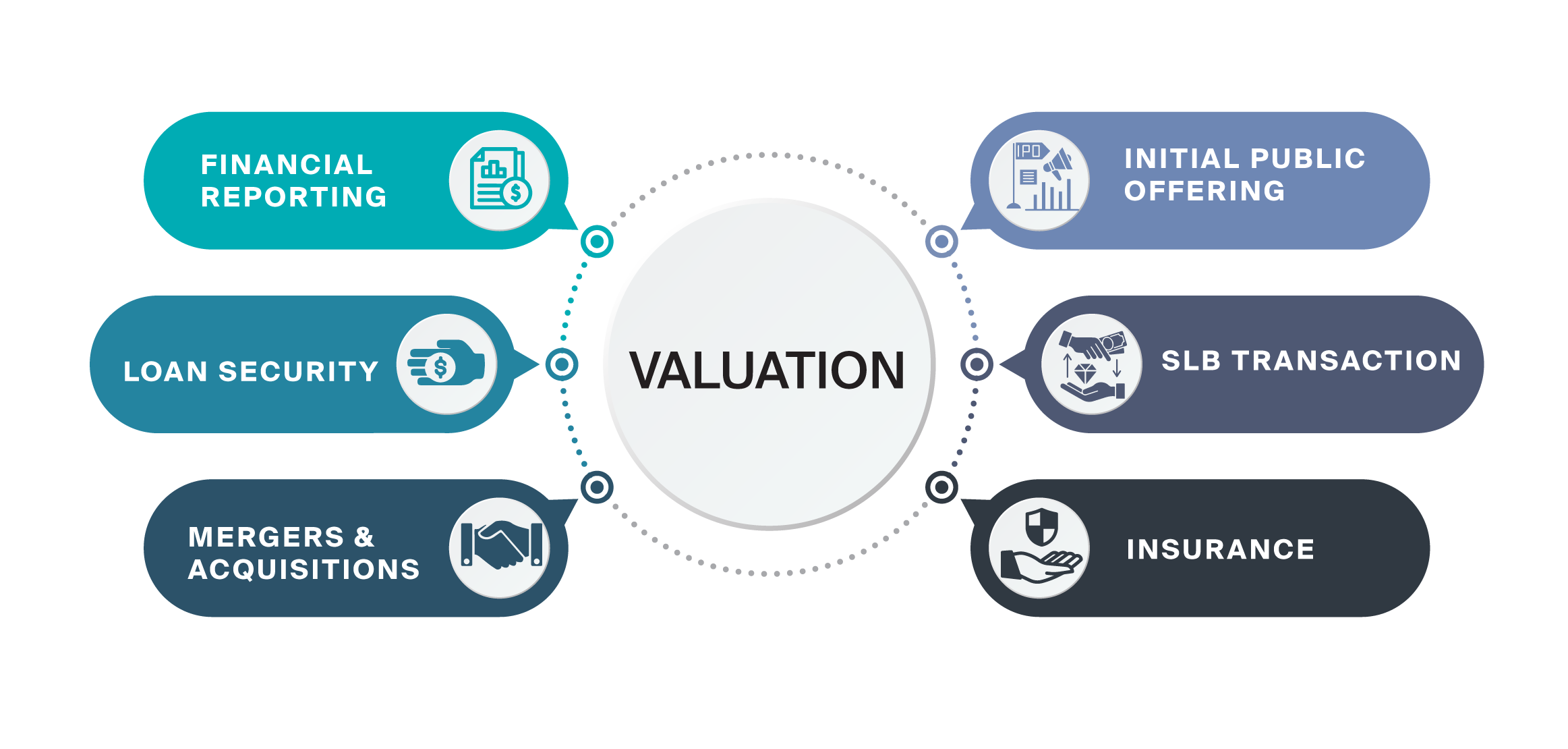

Where we can be of assistance to you

Recent changes by CMA on real estate valuation

At the beginning of the calendar year, the CMA allowed listed companies to opt for the Fair Value model under IFRS13 to measure property and investment property, while continuing to adopt the cost model to measure plant, equipment and intangible assets.

IFRS 13 defines fair value, sets out a framework for measuring fair value, and requires disclosures about fair value measurements.

The definition of Fair Value under IFRS13 is “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”.

The CMA has however specified six conditions which must be fulfilled for companies to adopt the Fair Value measurement for property and investment property.

Why adopt FAIR value measurement?

Income Reflection, Relevance and Accuracy

The fundamentals behind the Fair Value measurement are that “an entity uses the assumptions that market participants would use when pricing the asset or the liability under current market conditions, including assumptions about risk.” (IFRS). This makes accounting information more relevant to the actual market as of the measurement date and provide an accurate valuation.

Valuation support asset classes