Destination Egypt 2025: Discover the data

30 September 2025

Our survey reflects the views of HNWI from Germany, the UK, the US, Saudi Arabia, and the UAE to understand their appetite for investing in Egypt’s real estate market.

Each respondent reflects considerable purchasing power, with interest spanning giga projects, residential communities, and branded homes. Together, their insights underline Egypt’s growing role as one of the MENA region’s most dynamic real estate destinations.

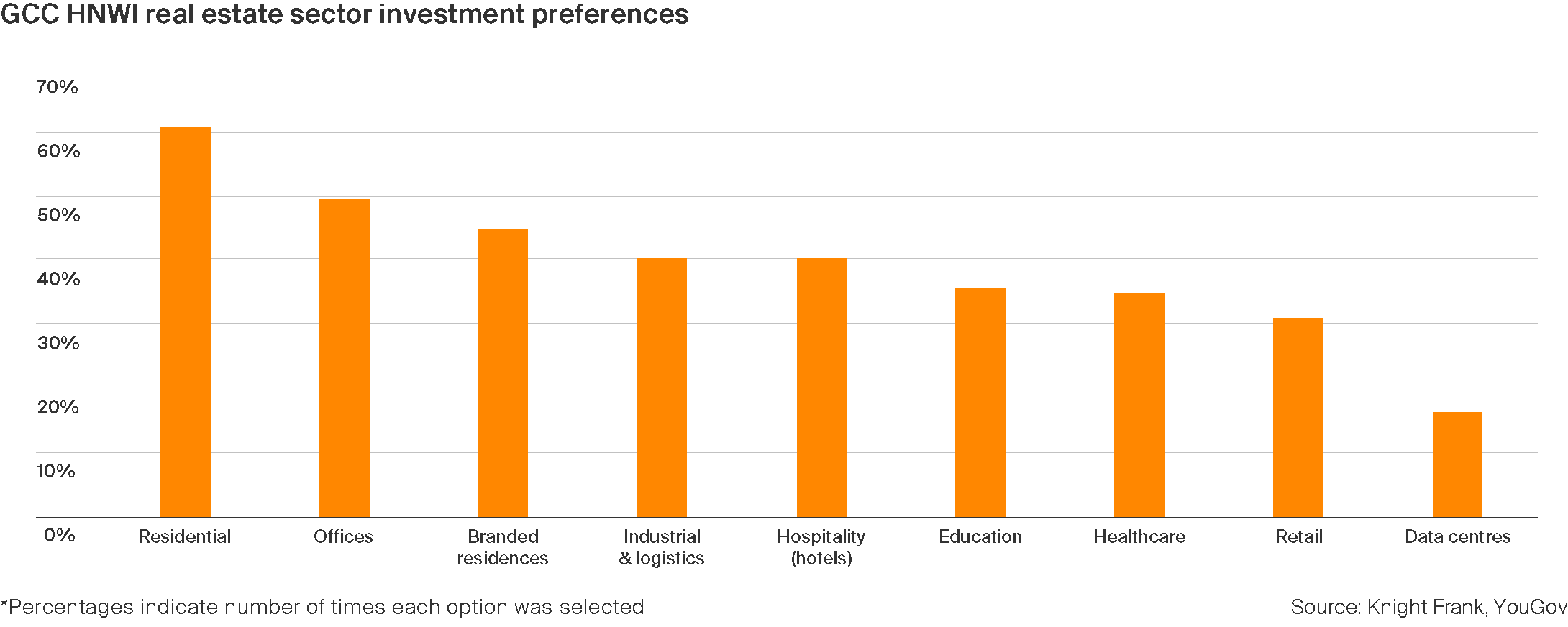

The report highlights where GCC HNWI see the strongest investment potential within Egypt’s real estate market. Residential ranks highest, selected by 61% of respondents, followed by offices at 49% and branded residences at 45%. These segments continue to attract consistent interest year-on-year, reflecting a strong focus on core asset classes.

Other sectors including industrial and logistics, hospitality, education, and healthcare are also being considered, reflecting the range of opportunities investors are exploring across the market.

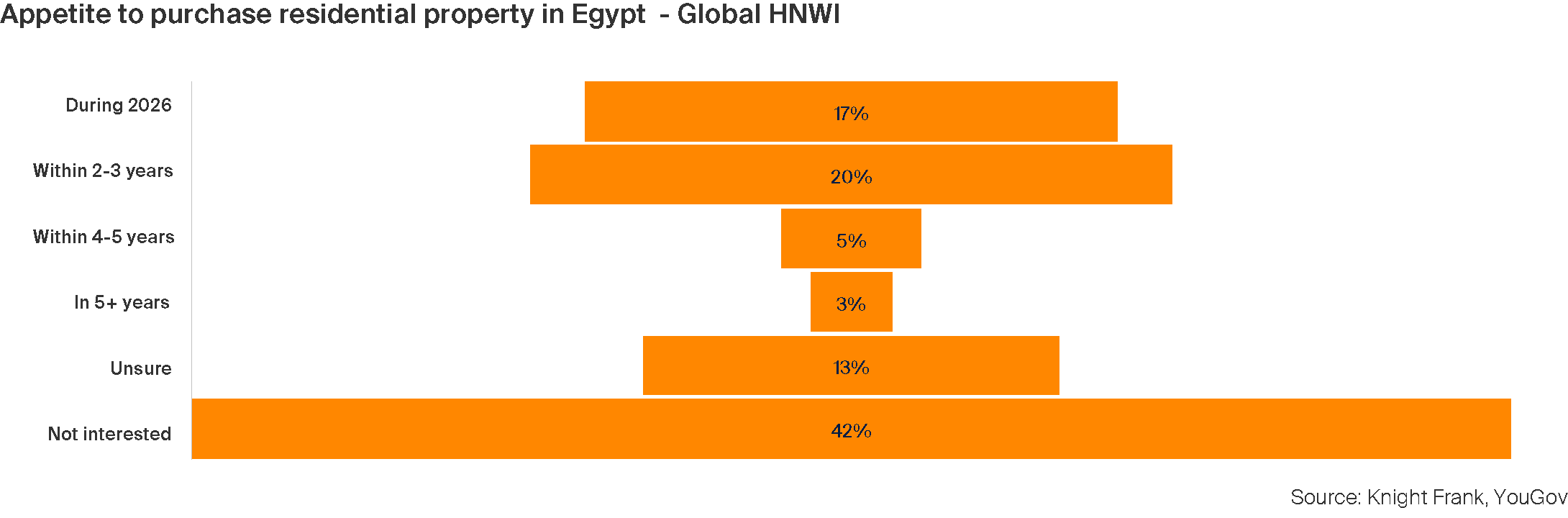

Our survey shows varied timelines for HNWI interested in purchasing residential property in Egypt. 17% of respondents plan to buy in 2026, while a further 20% expect to purchase within the next two to three years. Smaller shares are looking further ahead, with 5% targeting a four to five–year horizon and 3% beyond five years.

Uncertainty also plays a role, with 13% of respondents unsure of their plans and 42% not currently interested in buying. These findings highlight both the near-term opportunities and the longer-term potential for Egypt’s residential market.

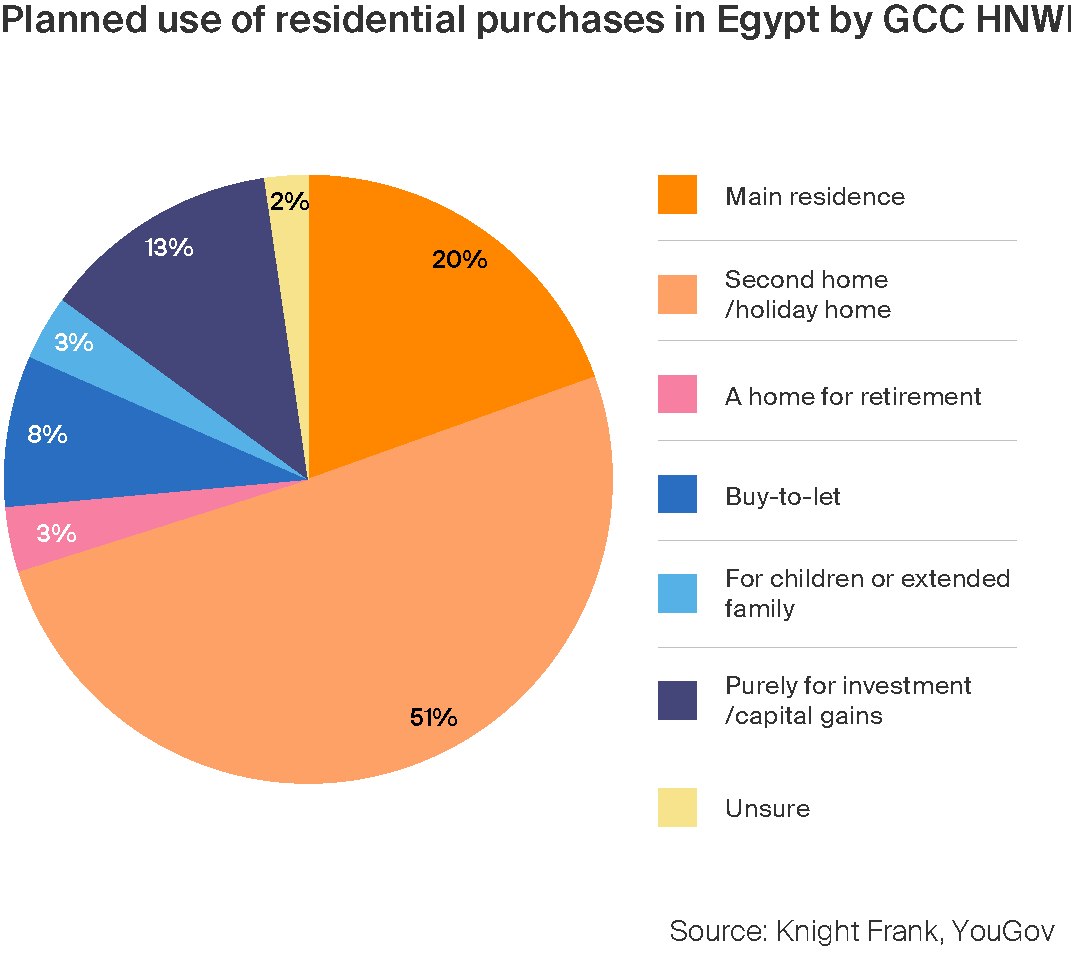

With “the availability of coastal properties” emerging as the main draw for global and GCC HNWI eyeing a residential purchase in Egypt, it is no surprise to find that more than half (51%) of respondents planning to purchase a second home or holiday retreat. A further 20% are seeking a main residence, while 13% are focused on investment and capital gains. Smaller shares are targeting buy-to-let opportunities (8%), retirement homes (3%) and properties for children or extended family (3%).

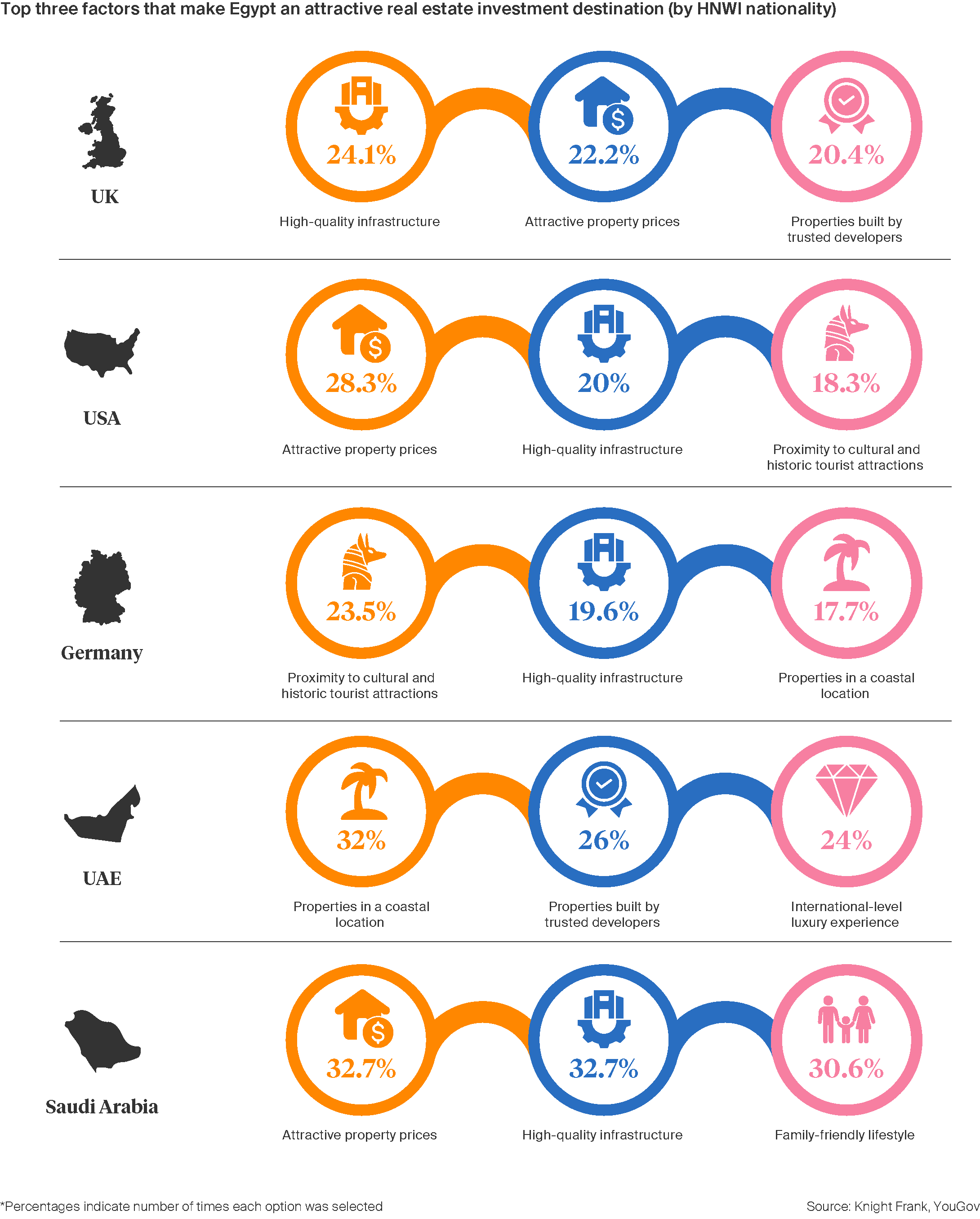

Our research has shown how priorities vary by nationality when it comes to investing in Egypt. For Saudi HNWI, attractive property prices (33%), high-quality infrastructure (33%) and a family-friendly lifestyle (31%) stand out. UAE buyers highlight coastal locations (32%), trusted developers (26%) and a luxury lifestyle (24%).

UK and US respondents focus on property pricing and infrastructure, while German investors place greater emphasis on cultural and historic attractions (24%), alongside coastal opportunities.

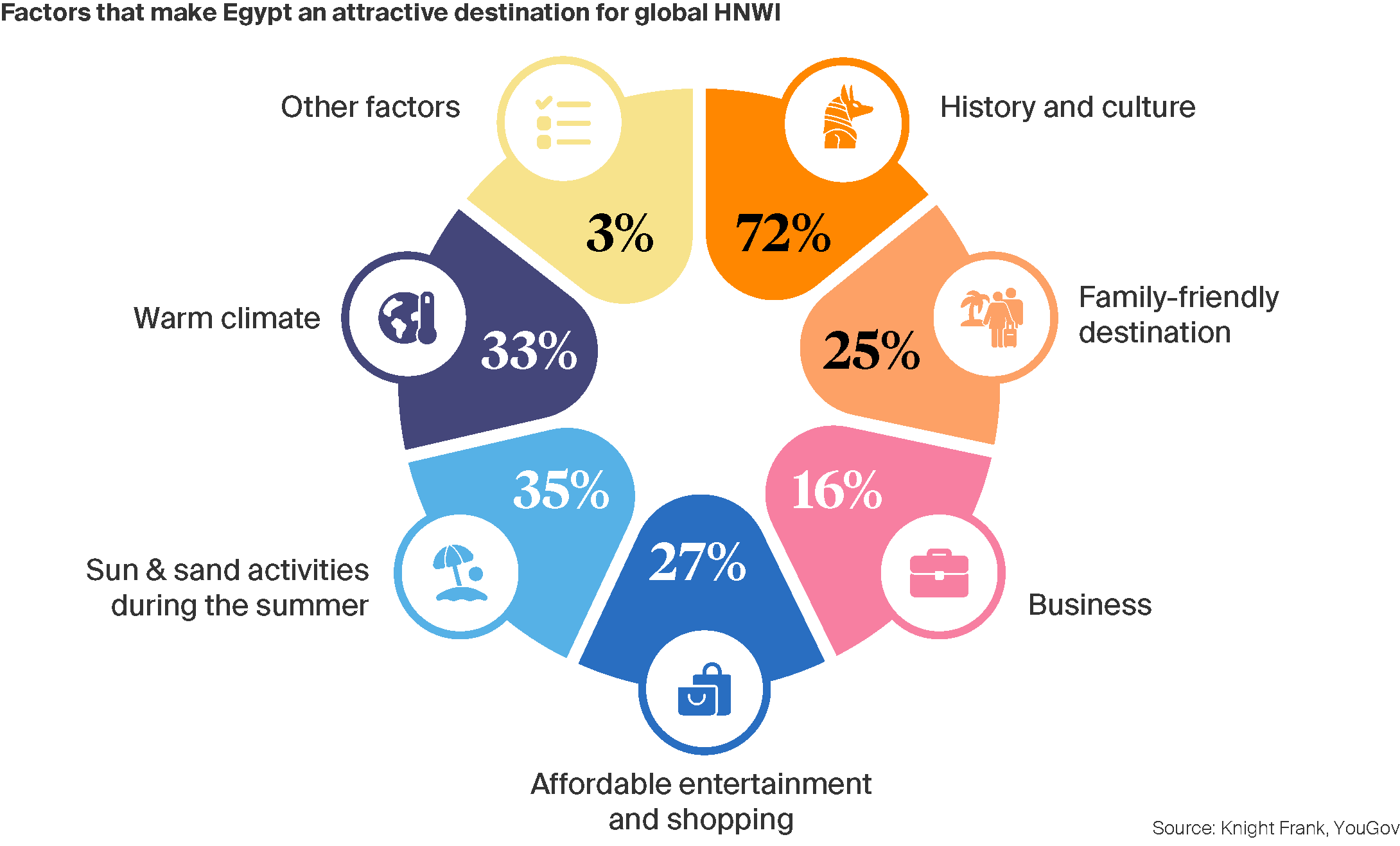

Global HNWI highlight several factors that make Egypt an attractive destination for investment and lifestyle. History and culture remain the strongest draw, cited by 72% of respondents, while sun and sand activities during the summer (35%) and the country’s warm climate (33%) continue to appeal to those seeking a vibrant lifestyle. Affordable entertainment and shopping (27%) and a family-friendly environment (25%) further enhance Egypt’s attractiveness, while business opportunities (16%) also contribute to its appeal.

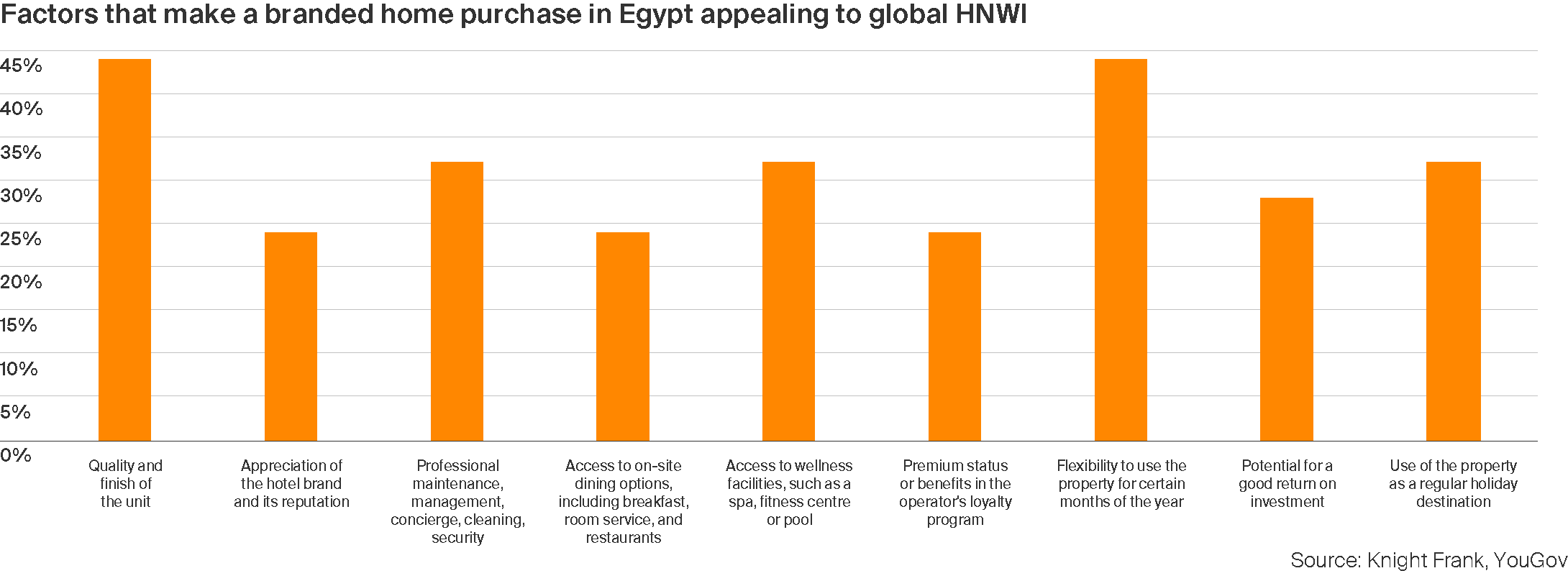

Our survey identifies what makes branded homes in Egypt appealing to global HNWI. The quality and finish of the unit and flexibility in how it can be used throughout the year are the most important considerations. Wellness amenities and essential services, such as maintenance, concierge, and security, also play a key role. Investors are also drawn to the option of using the property as a holiday or second home, potential for strong returns, on-site dining, the hotel brand’s reputation, and loyalty program benefits, all of which contribute to Egypt’s attractiveness as a destination for premium residential investment.