Destination Dubai - Discover the data

09 June 2025

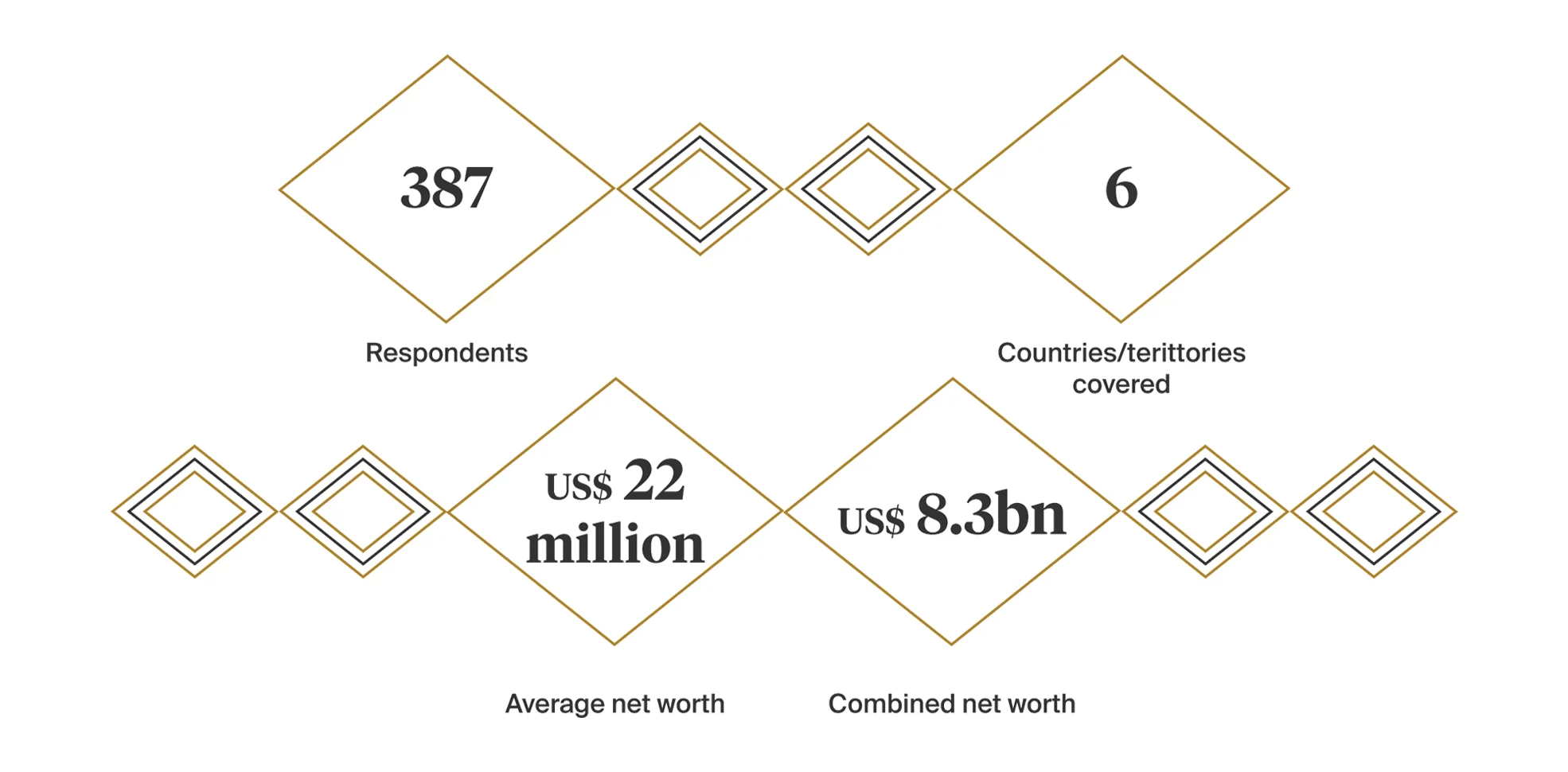

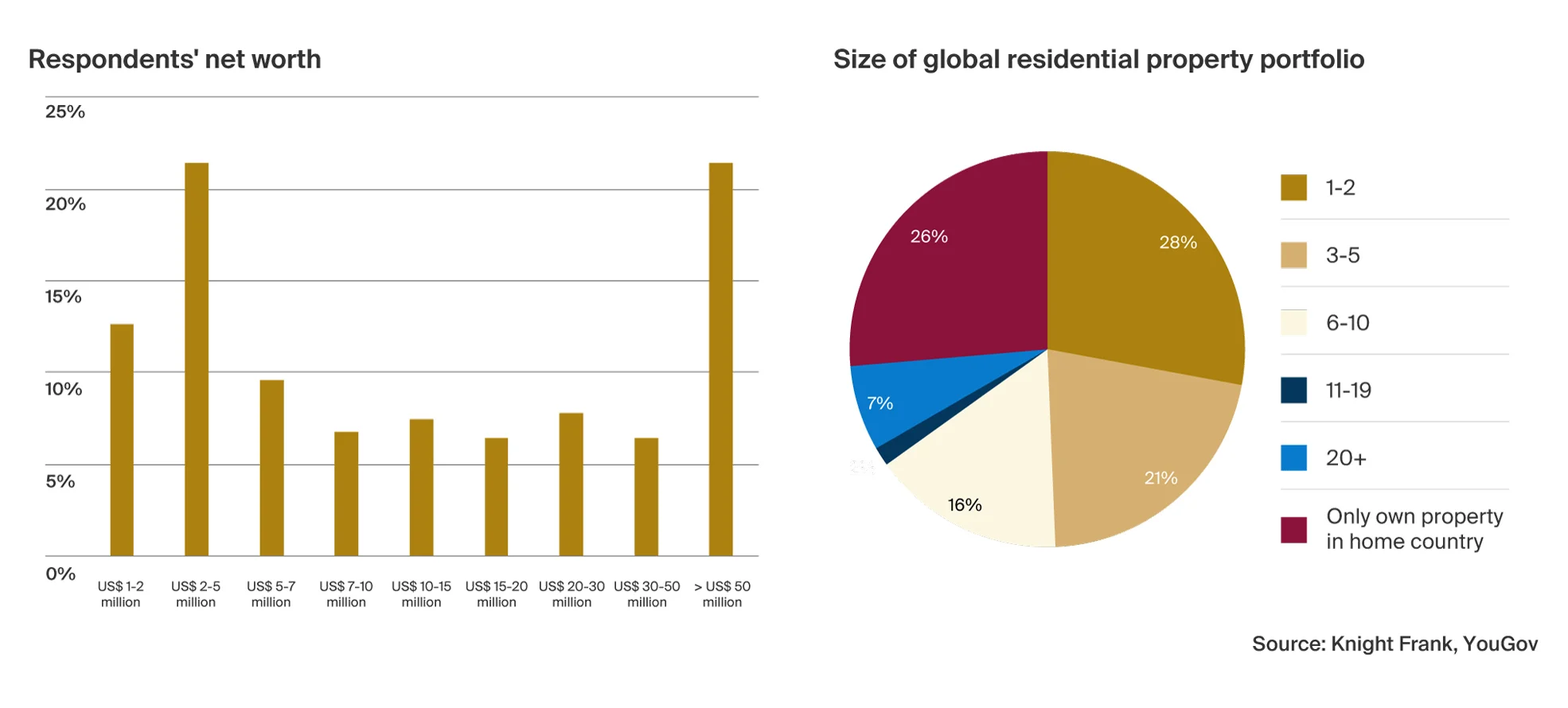

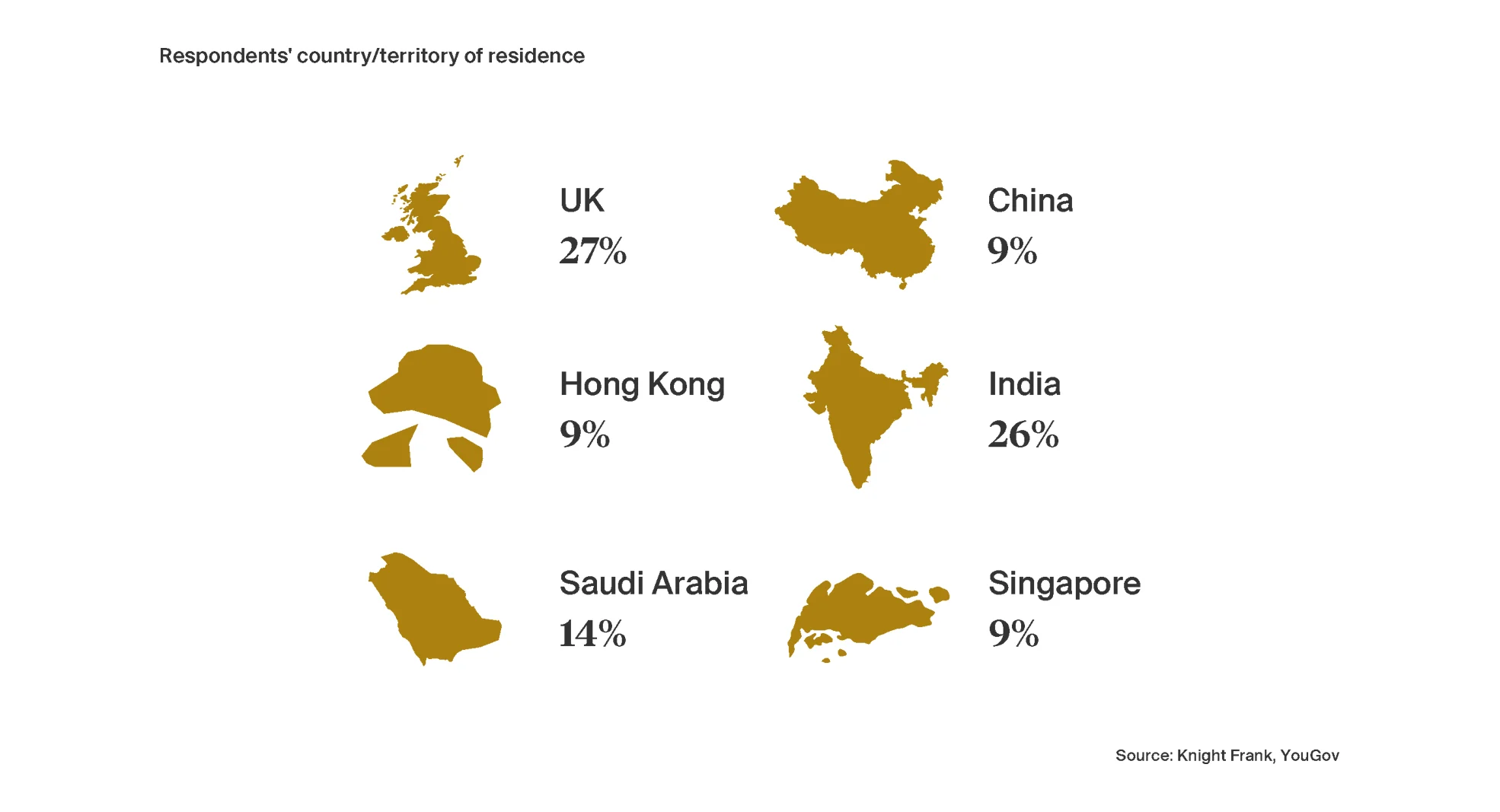

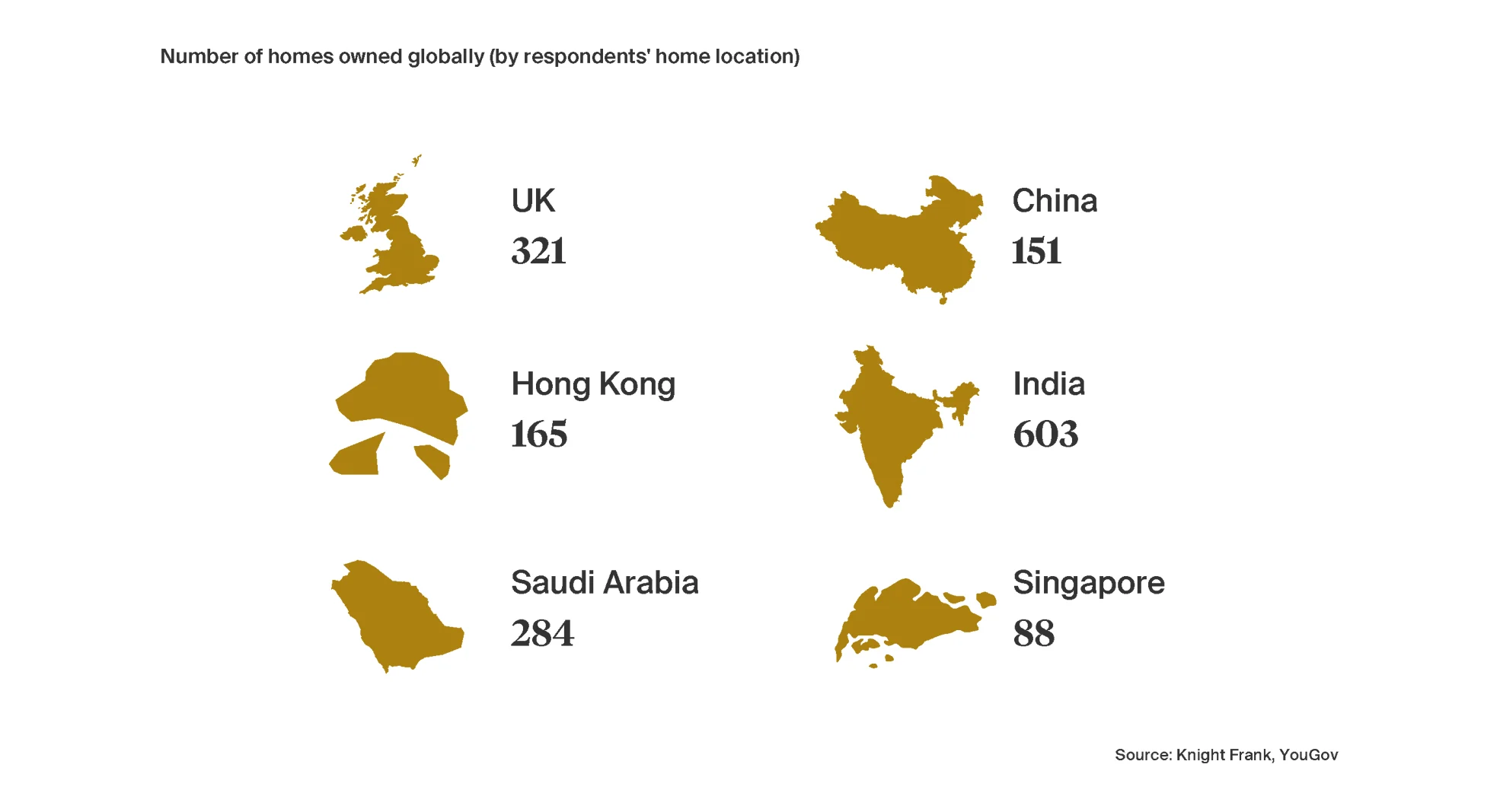

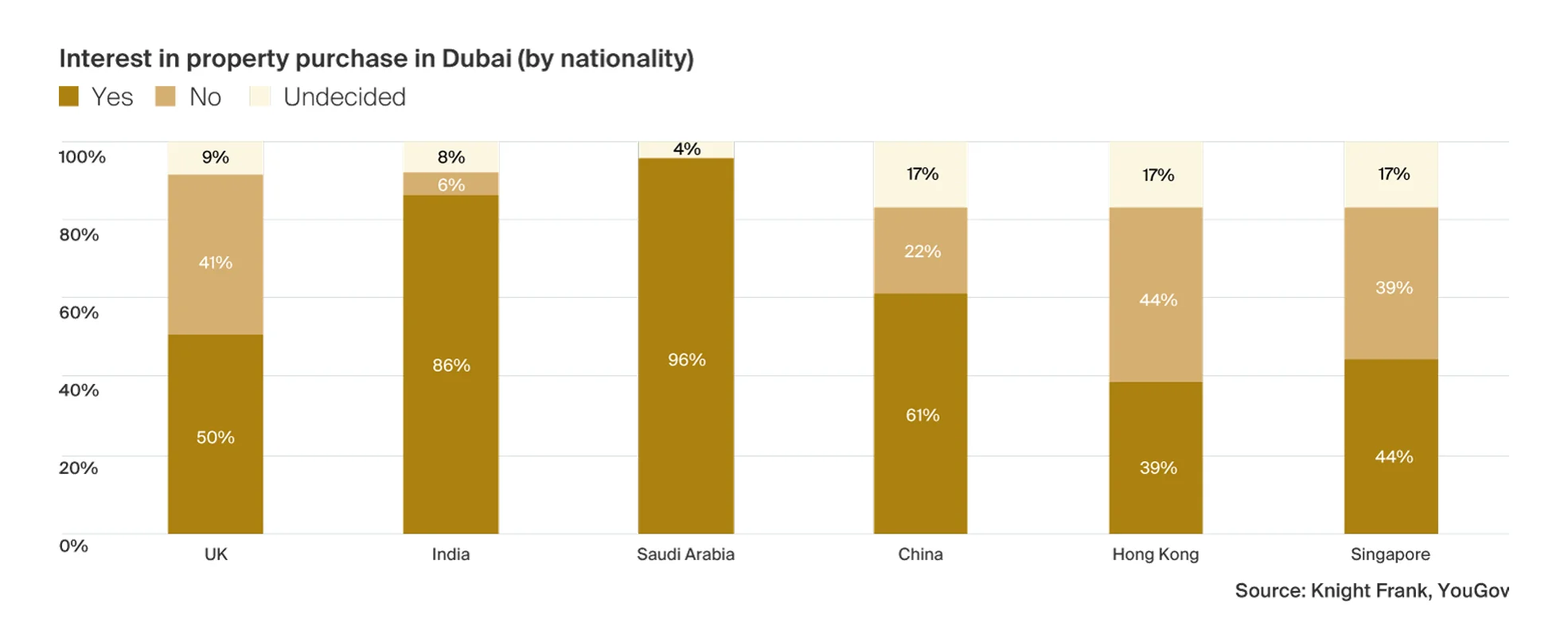

Our survey, conducted in partnership with YouGov, reflects the views of 387 high-net-worth individuals (HNWI) from India, the UK, Saudi and East Asia (China, Hong Kong and Singapore) to understand their desire to invest in Dubai’s property market.

Each HNWI we surveyed has an average net worth of US$ 22 million. We have focussed our attention on nationals from these nations and territories as these are the locations that have been and continue to be top source markets for purchasers of property in Dubai.

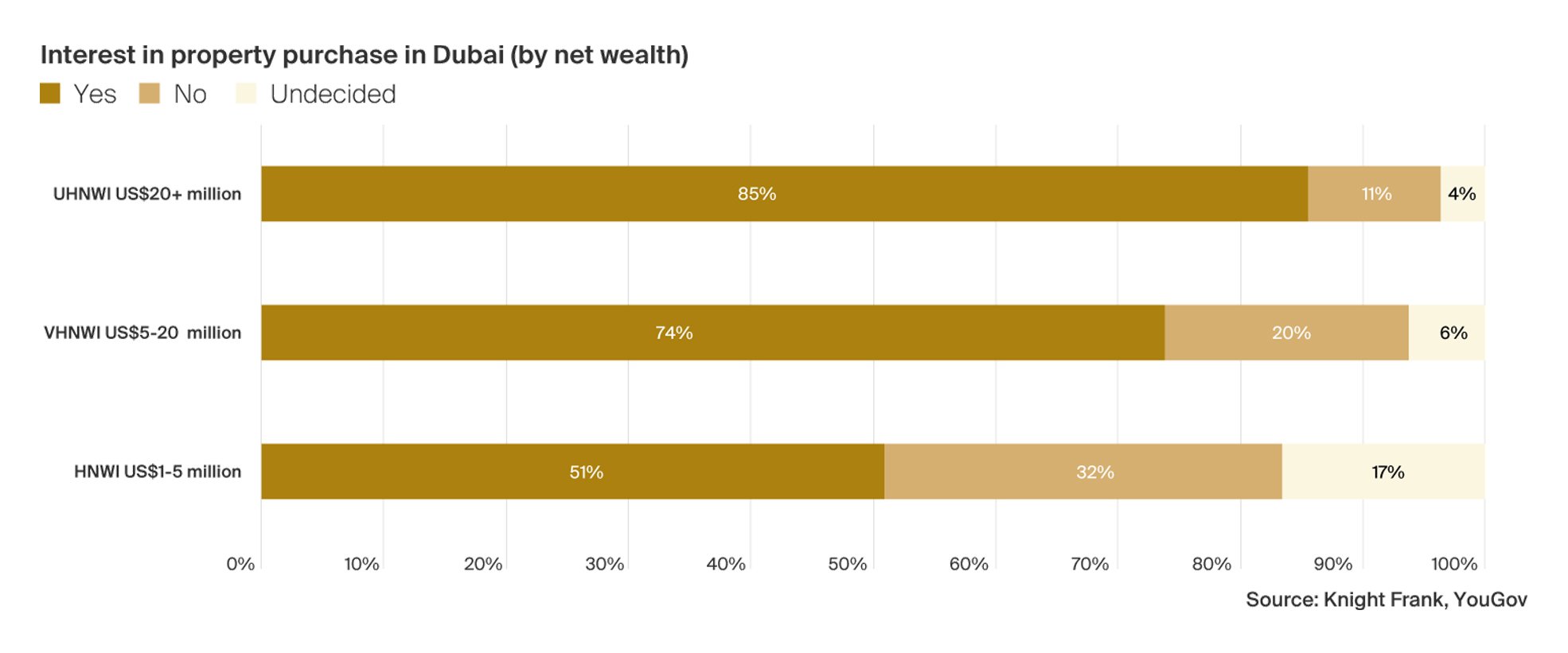

As we have found in our research in previous years and mirroring the experience of our teams, the strongest appetite for a real estate purchase in the UAE comes from those with the highest levels of wealth. 68% of those with a personal wealth of between US$ 30-50 million would like to invest in property in the Emirates this year, compared to just 12% of those worth US$ 2-5 million.

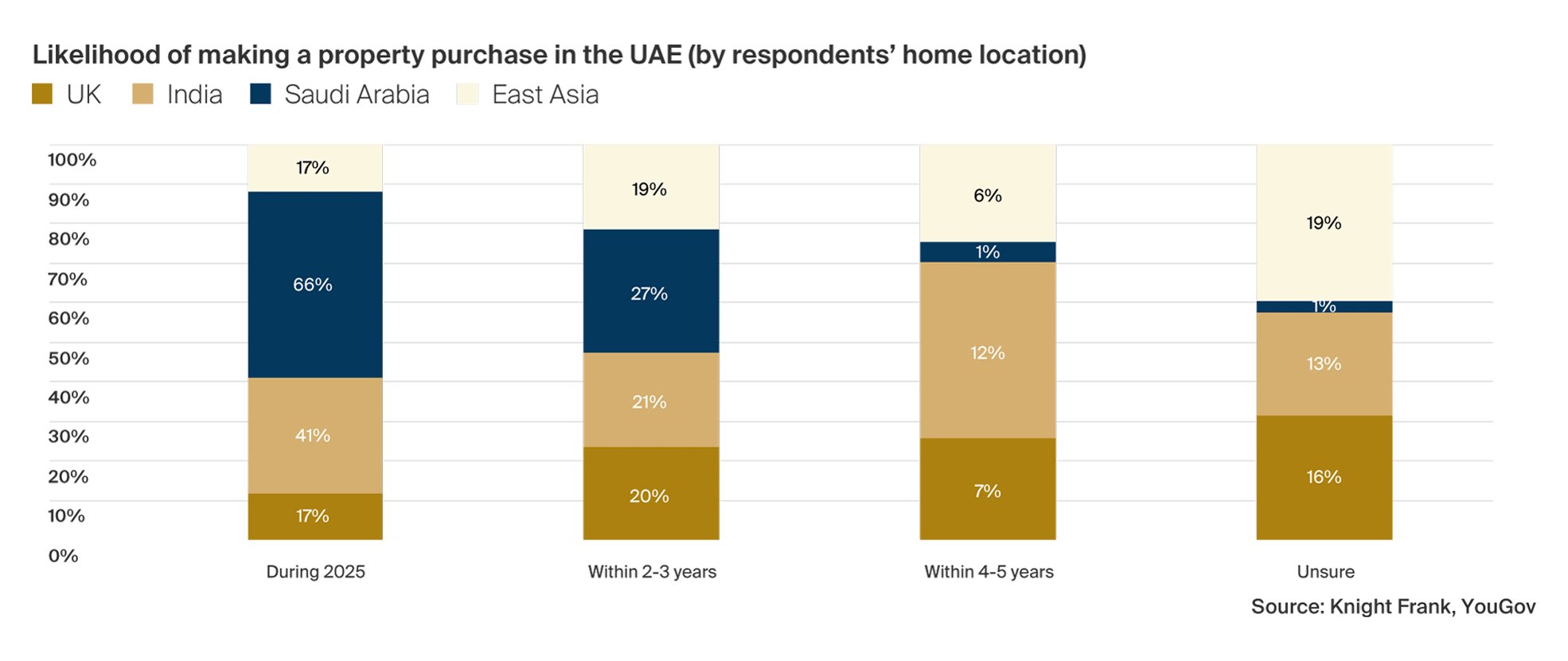

33% of all our survey respondents intend to invest in UAE real estate this year. Saudi HNWI have the strongest desire overall, with two-thirds (66%) planning a purchase in 2025. Additionally, 27% are considering a property acquisition within the next two to three years. After Saudi nationals, Indian HNWI have the strongest desire to invest in real estate in the UAE this year at 41%. While just 17% of East Asian HNWI respondents would like to purchase real estate in the UAE during 2025, the appetite is strongest amongst those from Hong Kong (22%).

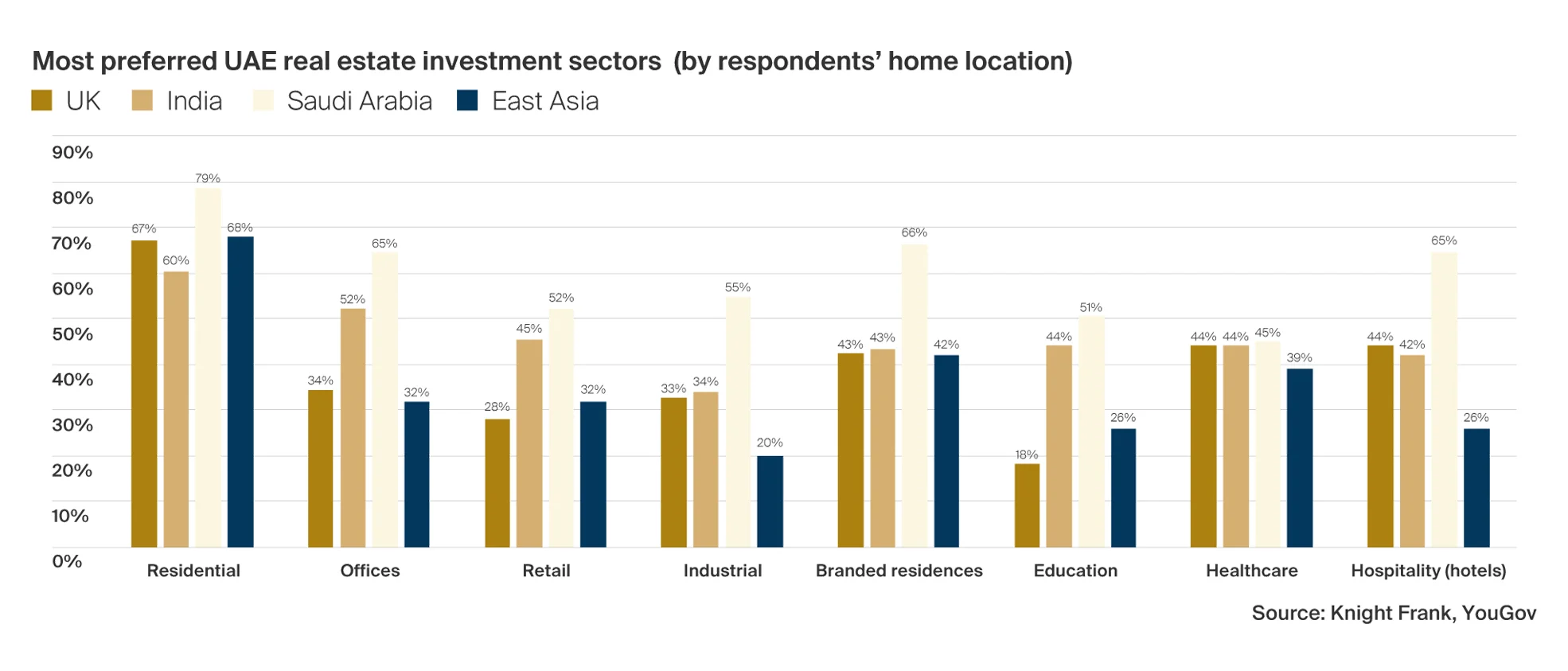

Our research has shown that the UAE’s residential market has historically been the most attractive sector for global HNWI, and our survey results this year continue to support this. 68% of our HNWI survey sample have named the UAE’s residential sector as their most preferred asset class target.

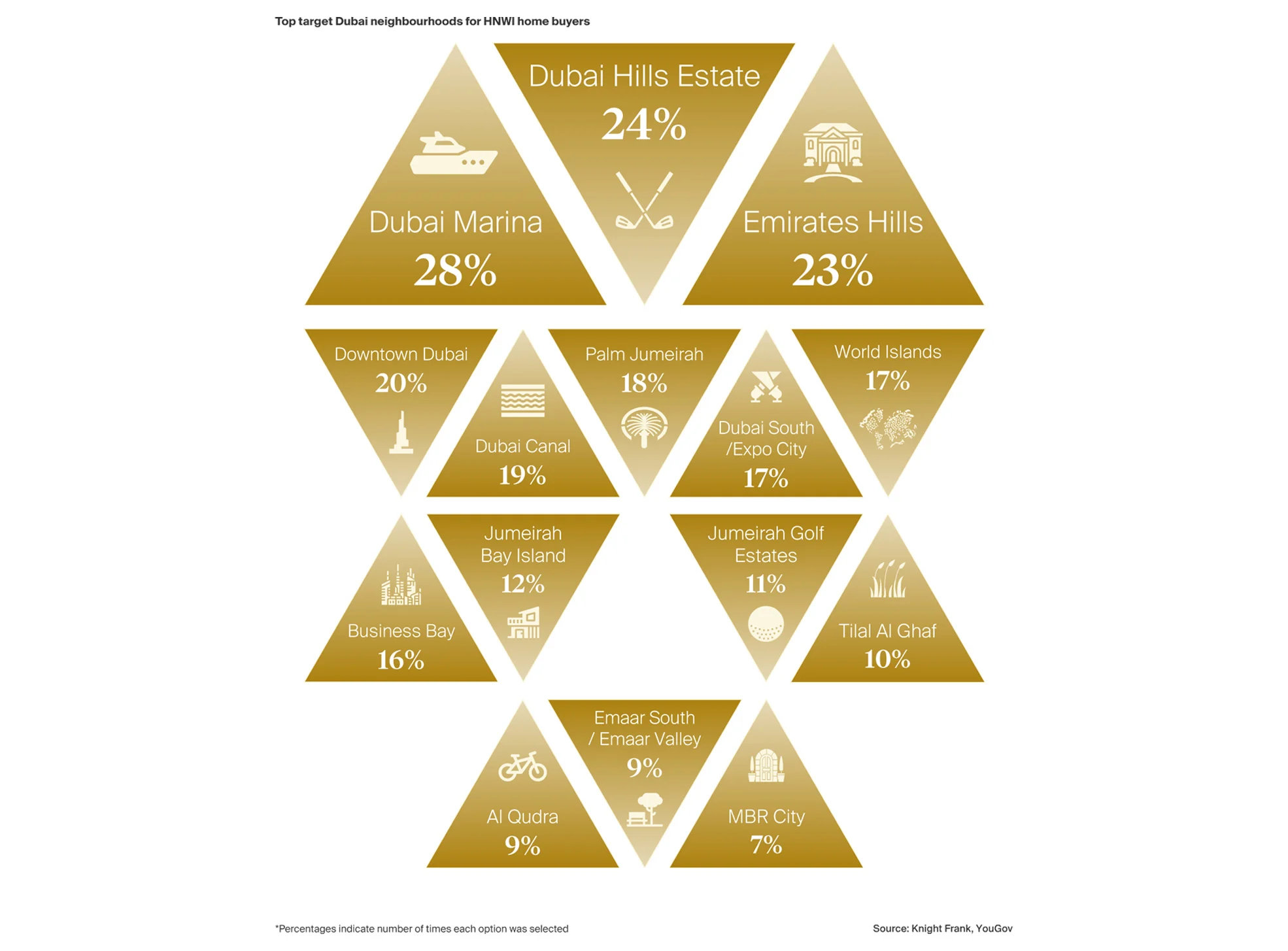

Dubai remains the top target for our HNWI survey respondents, with 68% interested in making a real estate purchase in the emirate. For our wealthiest HNWI respondents (net worth > US$ 50 million), Dubai Marina at 43% commands the highest interest, demonstrating the enduring appeal for the longstanding poster-child of Dubai’s property market.

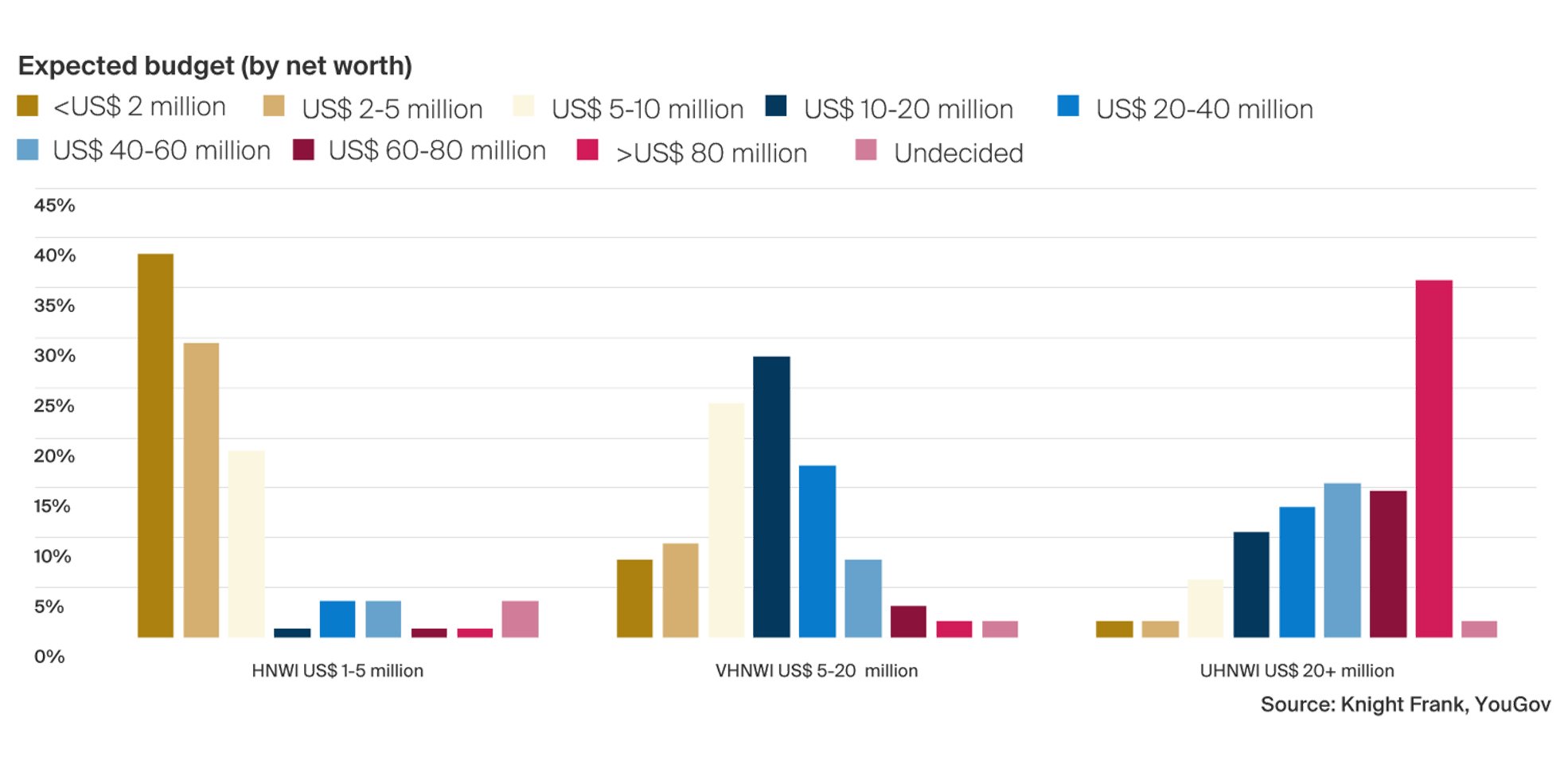

The average allocated budget for a home purchase in Dubai by the global HNWI respondents we surveyed is US$ 32 million, the highest levels of demand appear to be at the extremities of the market: 17% would like to spend less than US$ 2 million, while 15% are prepared to commit over US$ 80 million on a single residential acquisition.